Scotia Global Asset Management Investor Sentiment Survey highlights the need for financial advice.

Investors' confidence slow to recover, but a financial plan improves outlook

Key messages

- Canadians are feeling the pressure of higher living expenses on their investments, but research suggests professional advice and a financial plan can bring a significant confidence boost.

- Nearly 6 in 10 (58%) of respondents are concerned, worried or anxious about their investments.

- Those with a financial plan and those who have met with an advisor are more likely to view the current investment climate as a good time to invest.

Canadian investors continue to be wary of risks in the current economic climate and are concerned about falling short of retirement goals, our most recent Scotia Global Asset Management Investor Sentiment Survey shows.

At the same time, our findings suggest that investors who meet regularly with an advisor and those who have a financial plan are more likely to have a positive outlook, prioritize savings and stay focused on their retirement goal.

The online survey, conducted in November 2023 by Environics Research, included 1,028 Canadians, age 25 or older with investable assets of at least $25,000 and who participate in household investment decisions. The data was weighted by region, demographics and investable assets to reflect the wider population.

Key finding: Most feel sombre about their investments, but getting advice improves their outlook

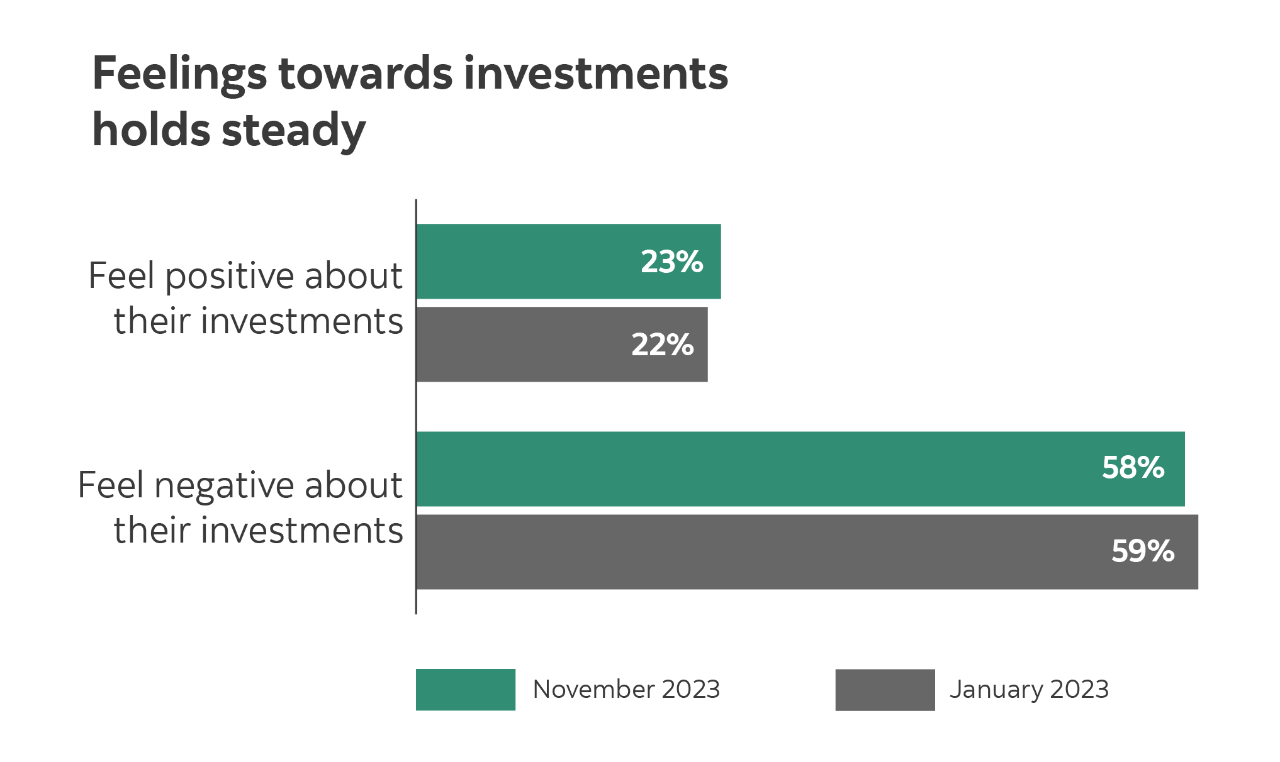

More than half of Canadians (58%) remain pessimistic about their investments, a sentiment holding steady from our previous survey in January 2023 (59%).

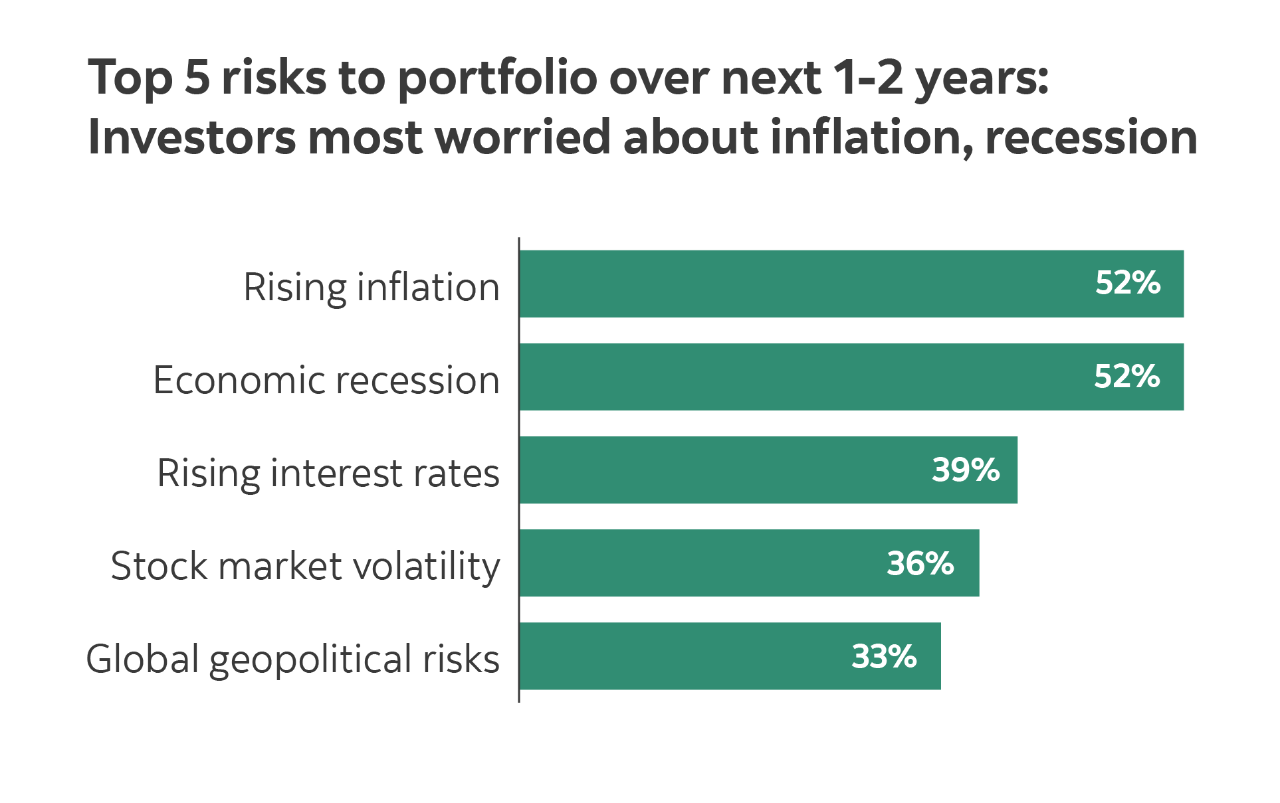

The risks of rising inflation and a possible recession were top concerns to the health of portfolios over the next two years. Nearly one in five respondents (19%) also expect to decrease contributions to their investments in the next year, with many feeling the pinch of increased household expenses.

Nearly half (47%) felt it was neither a good time nor a bad time to invest in the current climate, underscoring the value of seeking out professional advice.

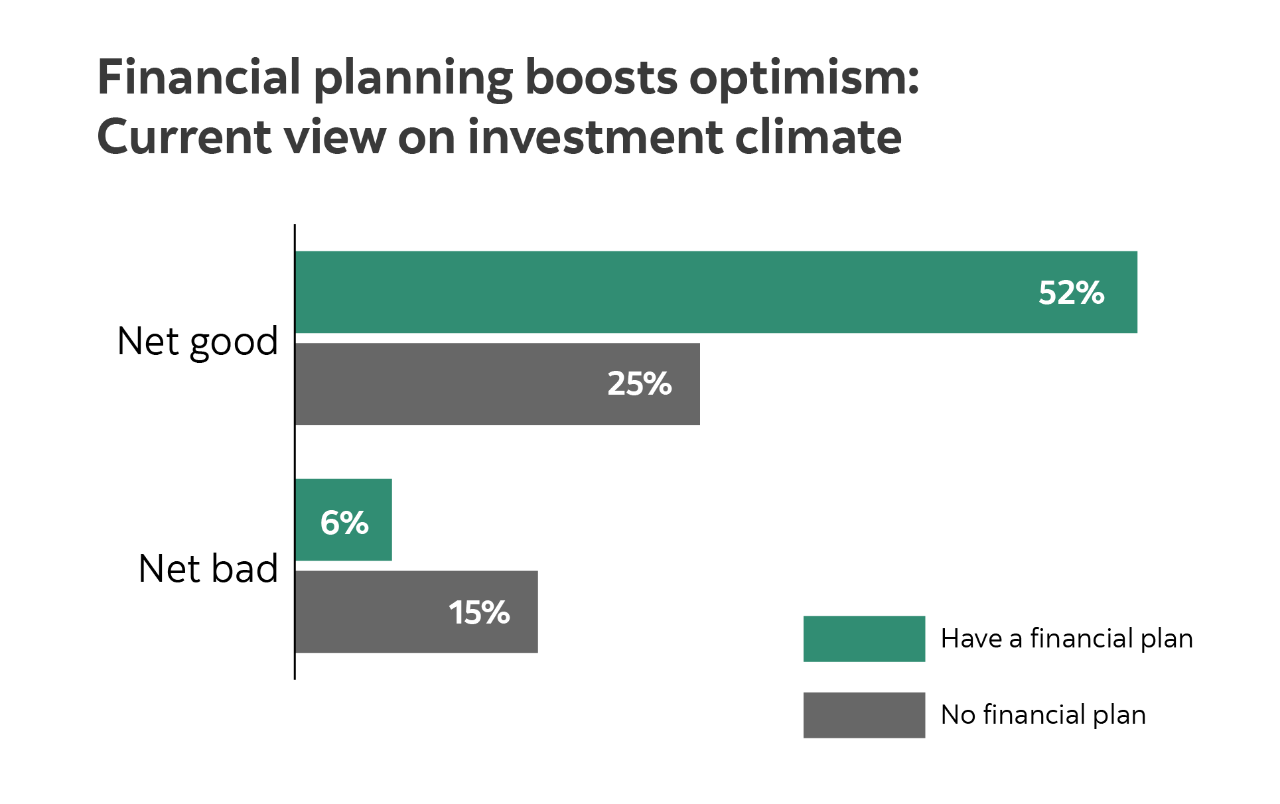

Advice makes a difference: Despite sombre sentiment, nearly a quarter of all respondents (23%) felt positive about their investments and more than a third of respondents believe it is a good time to invest (36%). Those who are more likely to view the current investment climate as a good time to invest include those who have a financial plan (52%).

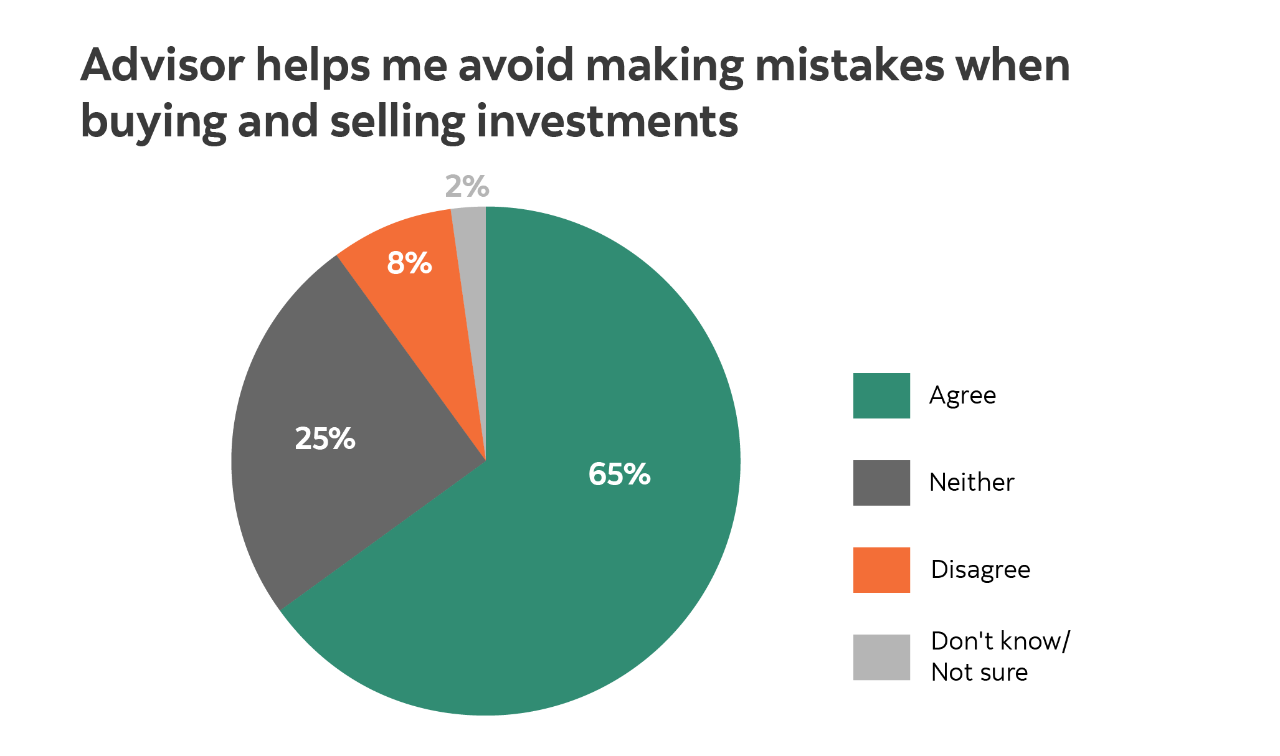

Among those who work with an advisor, two-thirds (65%) agree that their advisor helps them avoid making mistakes when buying and selling investments. This suggests that having a plan and working with an advisor can provide discipline to hold course through challenging times.

Market volatility can be unsettling and can lead to impulsive decisions that may not align with long-term financial goals. For instance, those who retreated or held back on investments last year due to uncertainty may have missed the strong year-end rally that accounted for much of the year’s gains. As highlighted in our 2023 Year in Review, most major indices defied expectations and reached new highs in 2023, bringing double digit returns.

Key finding: Less certain about funding retirement, Canadians seek reassurance

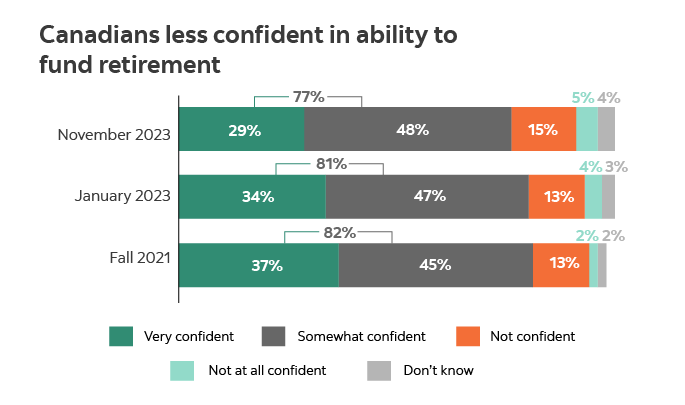

As the rising cost of living has squeezed budgets, inflation is also making some investors feel less certain about their retirement plans. Canadians' confidence in their ability to fund retirement declined from our previous survey period, from 81% in January 2023, down to 77% in November 2023.

Six in 10 (60%) respondents say that current economic conditions have impacted their retirement plans.

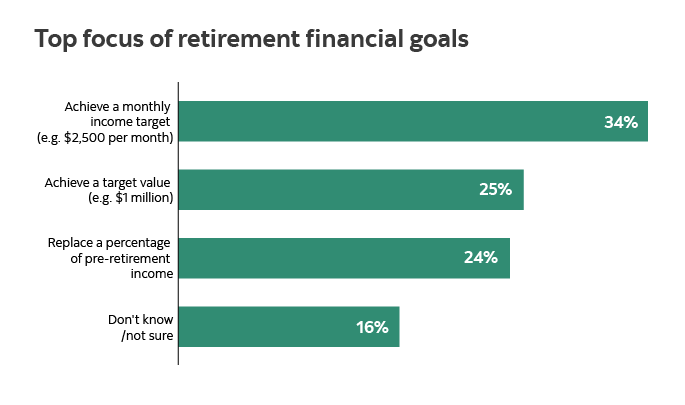

Being able to withdraw a specific monthly dollar amount in retirement was the most common financial focus for just over one third (34%) of investors who are not yet retired.

Positive impact of financial plans: Developing a personal financial plan can help ease concerns about short term market conditions, by including assumptions that anticipate ups and downs in performance and inflation.

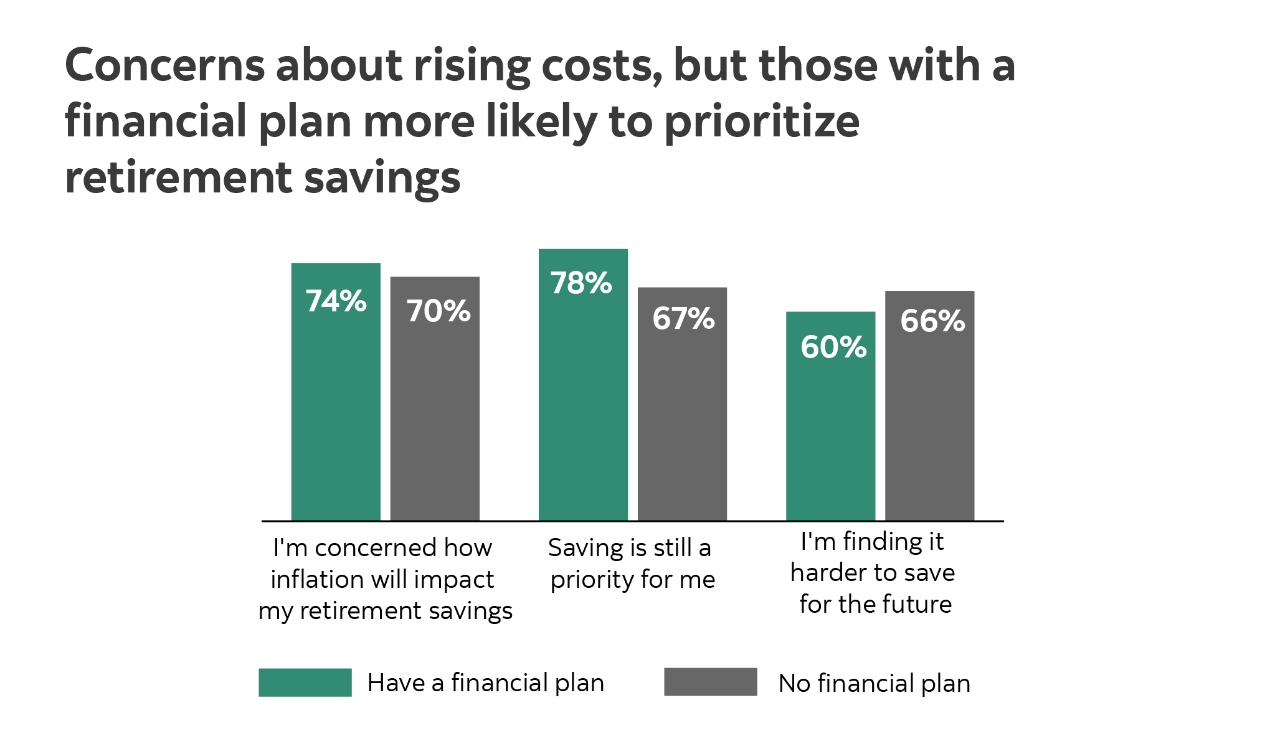

Those with financial plans are more likely to say that saving is still a priority for them despite higher living costs (78%) compared to those who don't (67%), according to our survey.

If you have doubts, it can make sense to meet with an advisor for a portfolio check-up and to revisit objectives. Those who prioritize monthly income at the top of retirement savings goals may benefit from strategies that can position a portfolio to pay out enough income to live comfortably in retirement.

Key finding: Working with an advisor raises confidence and improves outlook

The most confident investors in our survey were more likely to have a written financial plan and meet regularly with a trusted advisor.

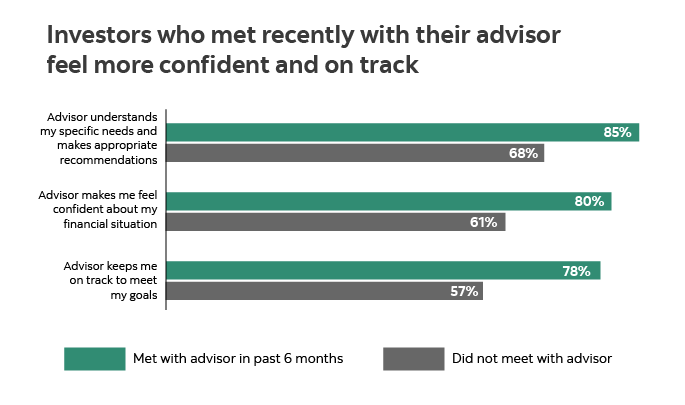

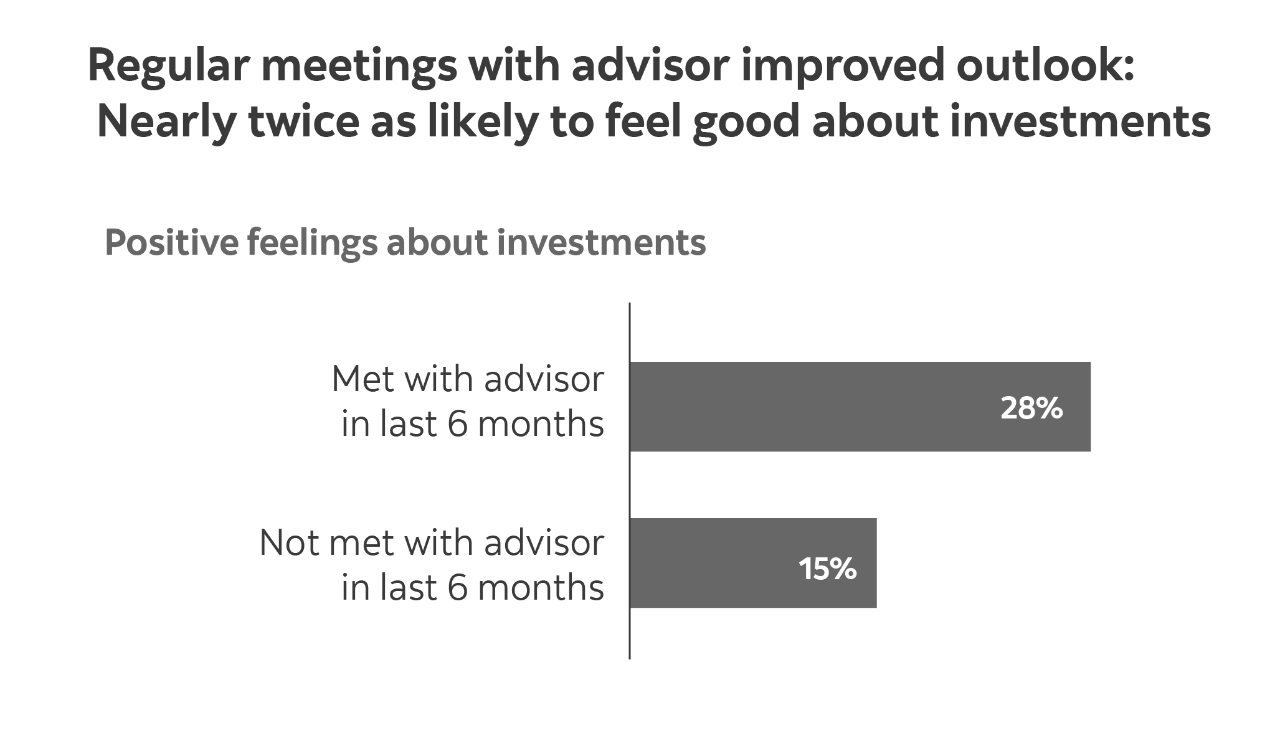

A steady seven in 10 Canadians say they work with a financial advisor to help manage their investments. But those who met more frequently, during the previous six months, tended to have more confidence in their advisors and be twice as likely to have a written financial plan.

Canadians who met with an advisor in the prior six months are also more likely to describe a positive sentiment towards their investments and agree that their advisor keeps them on track to meet goals.

Relying on help for decision-making: More than three quarters of people who work with an advisor (77%) agree that their advisor understands their needs and makes appropriate recommendations. And 72% say their primary advisor makes them feel confident about their financial situation.

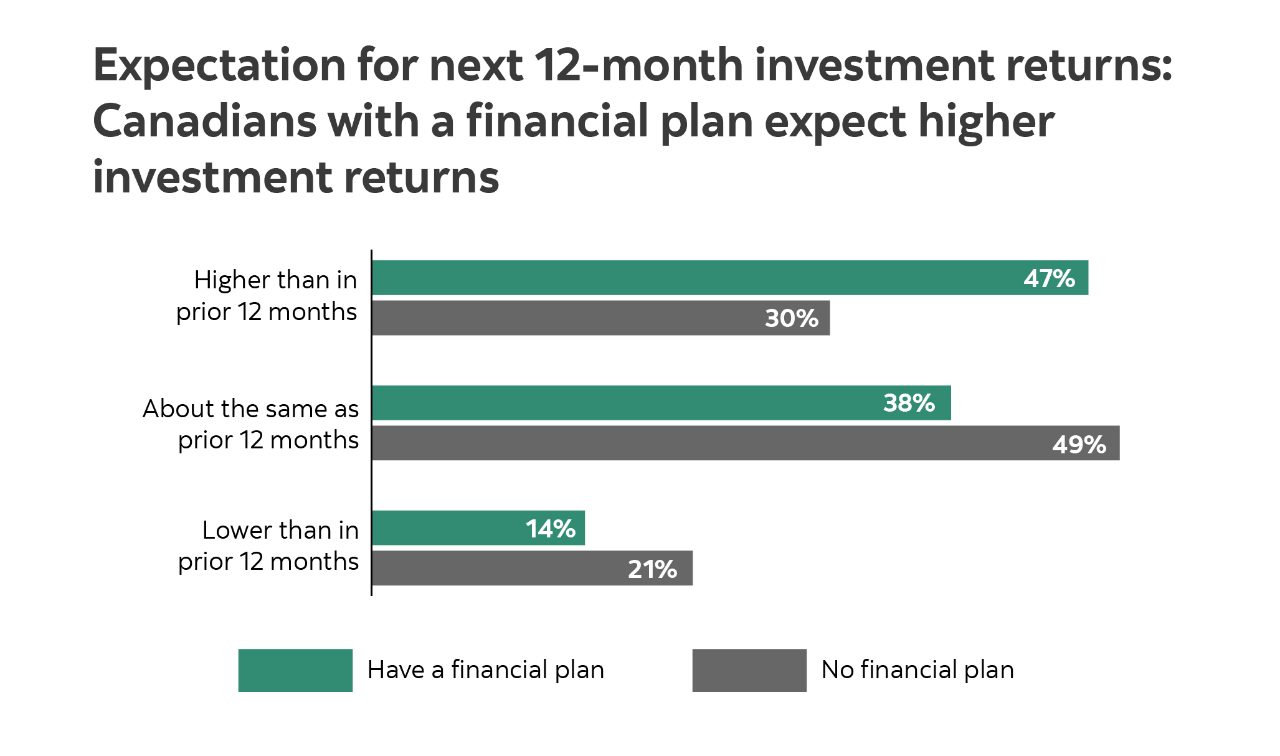

About half of those who have a financial plan have a positive view of the investment climate and their expectation of returns.

Working regularly with an advisor may help boost investor confidence in several ways. Your advisor can help put uncertainty in context with a long-term outlook, put the day-to-day market headlines into perspective, and help you stick to your investment strategy.

Boost your confidence with a check in

While economic and market conditions will inevitably change from year to year, the Scotia Global Asset Management Investor Sentiment Survey has consistently found that investors feel more confident in reaching their goals when they work with an advisor and have a financial plan in place.

These investors are also more likely to feel like their goals are on track and maintain a better outlook through difficult markets.

If you’re feeling uncertain about your financial future or how well you’re progressing towards retirement and investment goals, it can be reassuring to meet with an advisor.

Whether you're concerned about how the cost of living may affect your portfolio or you want to review savings and retirement strategies, your advisor can work with you to stay on track to reach your financial goals.

Reach out to your Scotiabank advisor or book an appointment today.

Related content

Investing through 2024 and beyond with robust portfolios

We examine the short-term and long-term considerations for our clients' portfolios. Let's compare our 12-month and 10-year perspectives. Learn more.

5 timeless tips on managing market ups and downs

In this article we provide you with some tips on how to manage - and potentially benefit from - market volatility.

2023 in Review: 5 essential investing lessons

Read about the key investing lessons from 2023 and learn time-tested investing strategies to help set yourself up for success in the new year and beyond.