Scotia Global Asset Management Investor Sentiment Survey (Fall 2025)

Survey suggests those with a financial plan feel most confident as economic uncertainty lowers sentiment

In a year that tested investors' emotions, survey finds advisors helped Canadians feel better about finances

Key findings

- Fewer think it's a good time to invest; more people shifted focus to managing day-to-day expenses.

- Economic conditions prompting more Canadians to revisit or fine-tune retirement plans.

- Investor confidence is consistently higher among those who work with an advisor and have a financial plan.

Equity markets delivered solid gains in 2025, yet investor sentiment dipped year-over-year in Canada amid the uncertainties of trade tariffs and the economy, according to the most recent Scotia Global Asset Management Investor Sentiment Survey.

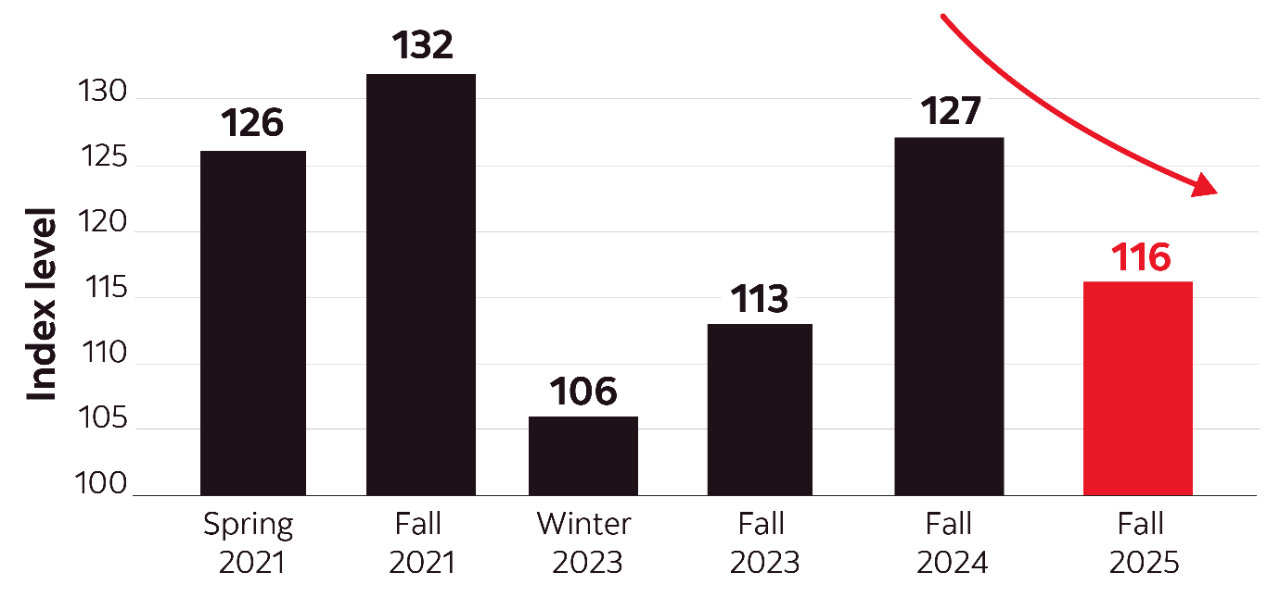

Figure 1: Scotia Global Asset Management Investor Sentiment Index declined in 2025

Canadians were evenly split between feeling positive or negative about their investments (44% vs. 44%), a shift compared to 2024 when more than half felt positive (51% vs 32%).

Millennial investors were more likely to say it was a good time to invest (43%), compared to Gen Xers (34%) and Boomers (32%).

Investors who have met with their advisor within the past six months, and who have a financial plan in place are more likely to feel positively towards their investments (57%).

About the survey. Conducted online between October 28th and November 6th, 2025 by Environics Research, the Scotia Global Asset Management Investor Sentiment Survey polled 1,045 Canadians aged 25 or older with investments of at least $25,000 and who have a say in household investment decisions. Data was weighted by region, age, gender and investable assets to reflect the wider population.

Cost of living and recession worries seen as greatest risk to portfolios

The top risks to investment portfolios over the next one-to-two years respondents cited were the cost of living (49%), fears of an economic recession (49%) and trade tariffs (46%).

While worries about interest rates dropped substantially year over year, from 34% to 23% of respondents —unsurprising given the easing of rates since Fall 2024 — findings suggest that other pressures on household income are affecting savings and investments.

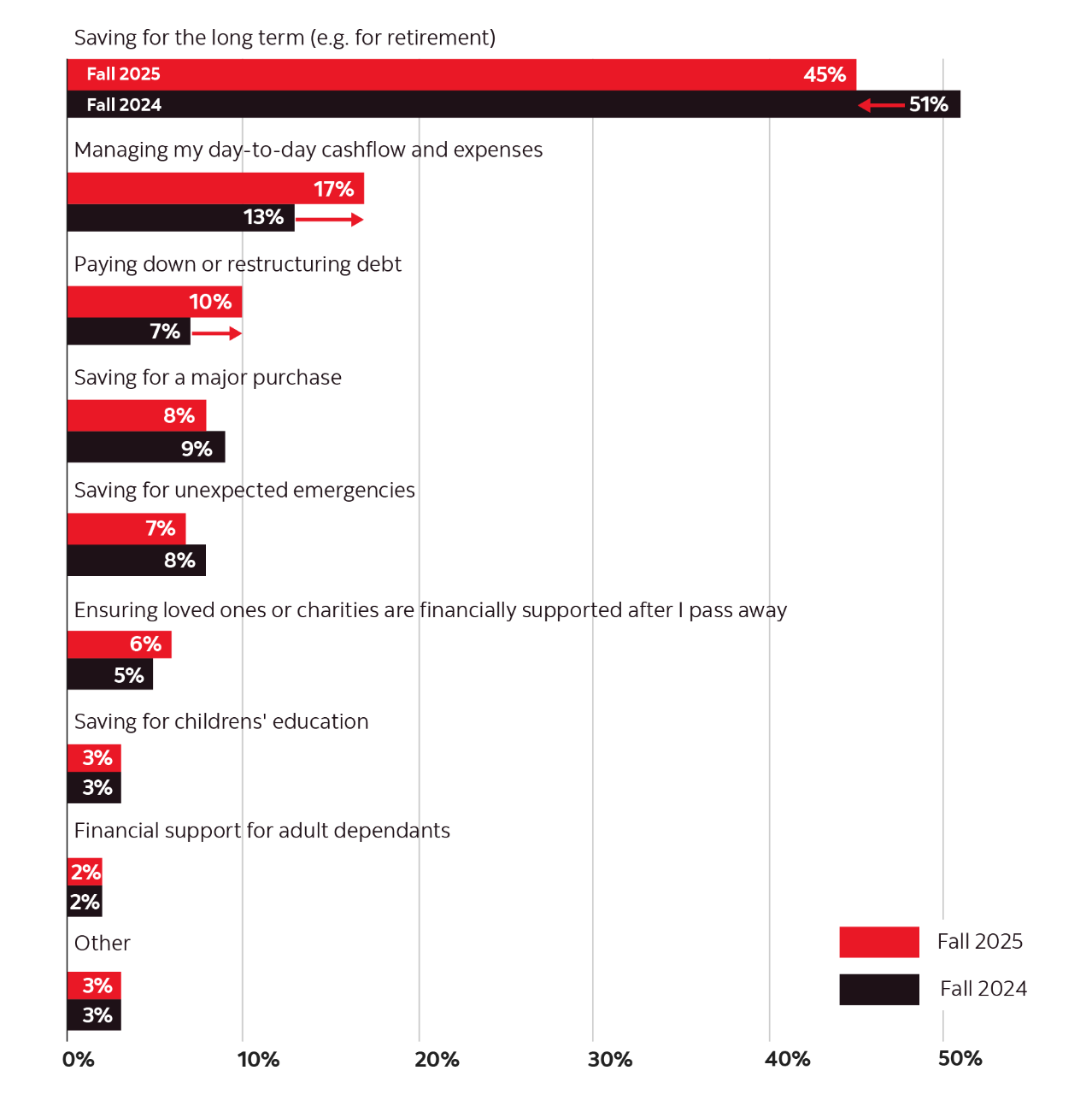

Compared to the previous year, more Canadians are prioritizing short-term needs like cashflow and debt repayment, with some pulling back on prioritizing long-term and retirement savings.

Figure 2: Financial priorities have shifted towards managing expenses and debt

While six in 10 (62%) of those who invest regularly through Pre-Authorized Contributions (PACs) say they are "very likely" to keep doing so over the next six months, nearly a third (32%) temper this as "somewhat likely," pointing to some uncertainty in contributing this way in the short-term.

Don’t abandon plans, but recalibrate, if necessary. Work with an advisor to review spending and savings, and manage the long-term impact of adjusting investment contribution levels over time. Thoughtful adjustments can help maintain progress, even as budgets tighten, so your portfolio can continue to gain momentum towards your savings goals. Plus, staying invested even through challenging markets can also help to improve outcomes over time.

Current economic conditions prompt a check-in on retirement plans

Most investors say they are very, or somewhat, confident in their ability to fund their retirement (78%).

While having confidence that they'll be able to fund retirement in general, respondents were not completely worry-free in the short term: When asked specifically how they felt compared to a year ago, more than a third of respondents (38%) said they were more concerned about funding their retirement.

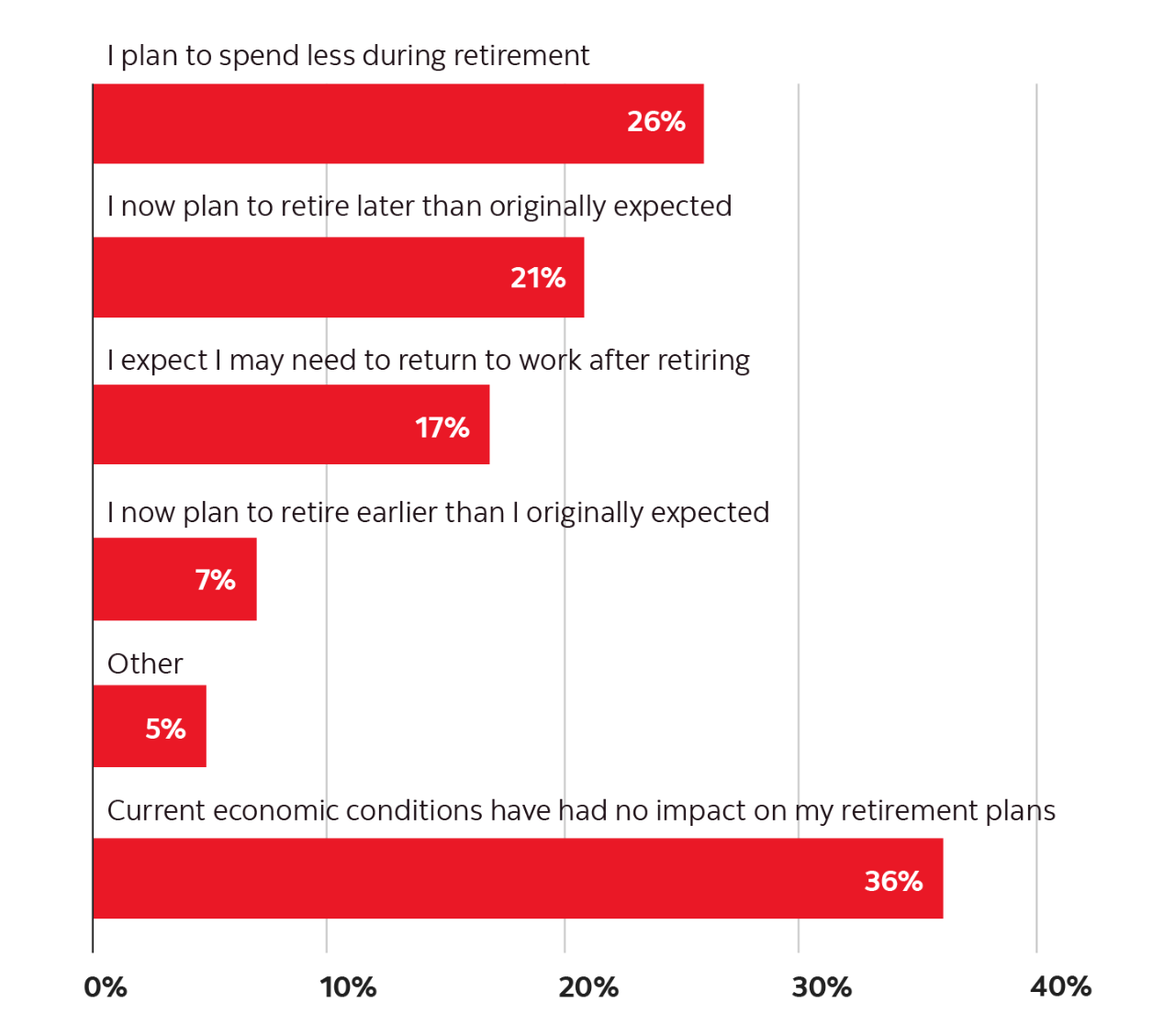

Nearly two-thirds (64%) say current economic conditions have impacted retirement plans. The biggest anticipated changes are to reduce spending in retirement (26%), retire later (21%) or to return to work after retirement (17%).

Figure 3: Current economic conditions have impacted retirement plans

Investors who were more likely to be not confident in funding their retirement include those who did not have a financial plan in place (35%), people who had little investment knowledge (36%) and the Gen X (25%).

Investors who were more likely to be confident in funding their retirement include investors whose primary advisor is an independent advisor (91%) or bank brokerage advisor (87%), or who have met with their advisor in the last six months (84%).

Professional advice can help smooth your road to retirement. Regular reviews with an advisor to cover your goals, investments, and retirement income needs can make it easier to balance short-term cash flow with long-term plans. An advisor can show you the impact of contribution changes, ensure your portfolio remains diversified, reflective of your preferences and well-positioned to meet your investment goals.

Advice can support a more confident outlook, even in unsettled times

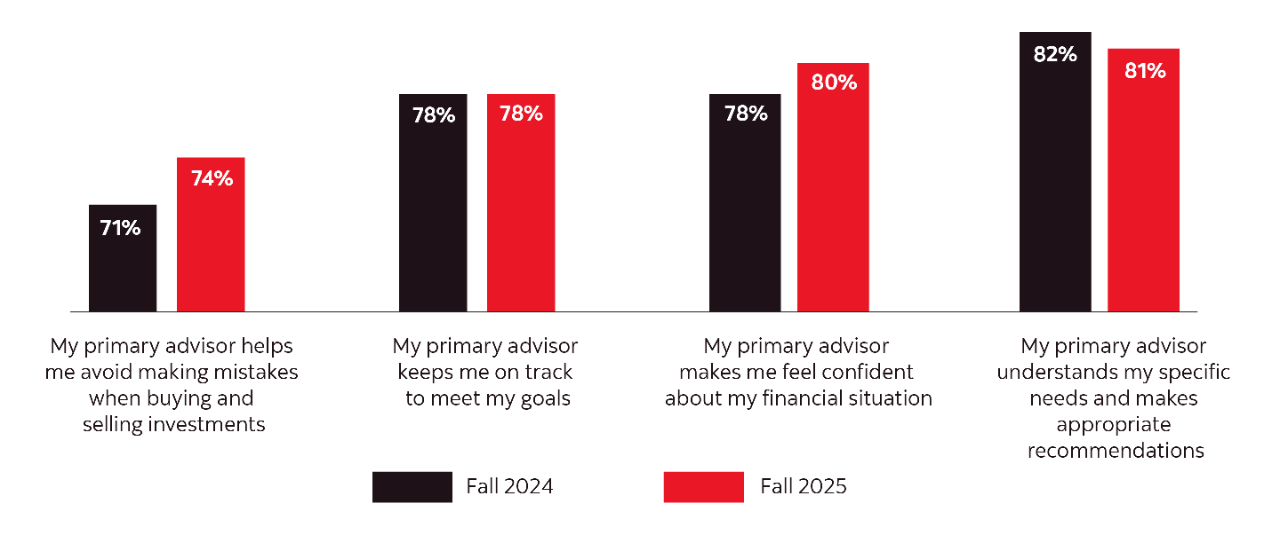

Despite feeling economic uncertainties, investors who seek professional advice and have a financial plan are consistently more confident about investments and have a more positive outlook on their finances.

Eight in ten say their primary advisor understands their specific needs and makes them feel confident about their financial situation.

Figure 4: Investors largely credit their advisors for understanding needs, boosting confidence

Among those who met with their advisor in the past six months, 86% say they feel confident in their financial situation, compared to only 68% who had not met with their advisor during that time frame.

More than half (57%) of investors would like additional assistance from their advisor to feel more confident about their investments.

Getting advice builds confidence through times of change. Even when markets perform well, other economic and day-to-day financial pressures can test investor confidence and shift financial priorities away from savings. With an advisor and a financial plan in place, investors are better positioned to stay resilient through changing circumstances. Speaking with an advisor can provide context to market headlines to help you stay disciplined and make sound investment decisions. Over time and across market conditions, the survey shows that regular check-ins help ease anxiety, especially for investors who may be less optimistic about the near term.

New for 2025: Tech-driven financial help from Artificial Intelligence (A.I.) and social media

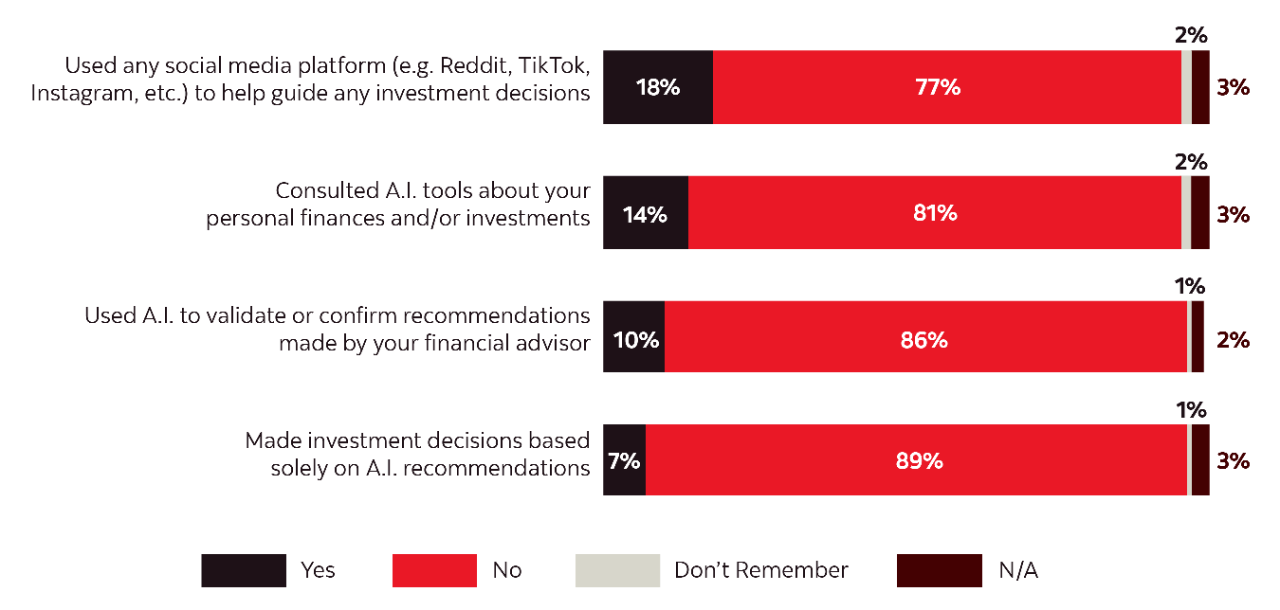

Canadians have access to a growing range of online resources and A.I.-powered services available to help manage their finances. Our survey addressed this, and a new survey question asked in 2025 shows that in the past 12 months, nearly one in five investors have used social media to help guide investment decisions and 14% have consulted A.I. tools. However, only 7% of all investors say they have made an investment decision based solely on A.I. recommendations in the past year.

Not surprisingly, younger investors are the most likely to have used this form of input on their investments: About four in ten (43%) investors under 40 years old have used social media to help guide investment decisions and nearly four in ten (38%) have consulted A.I. tools.

Approximately two thirds (65%) of investors under age 40 still use an advisor as the primary way to manage their investments.

Gen X, Boomer and higher-net worth Canadians are more likely to say "no" to consulting any kind of social media for finance or investment advice over the previous 12 months. Skepticism of A.I. tools was also higher among women and investors 40 years old or older.

Figure 5: Usage of social media and A.I. in investing in the past 12 months is low

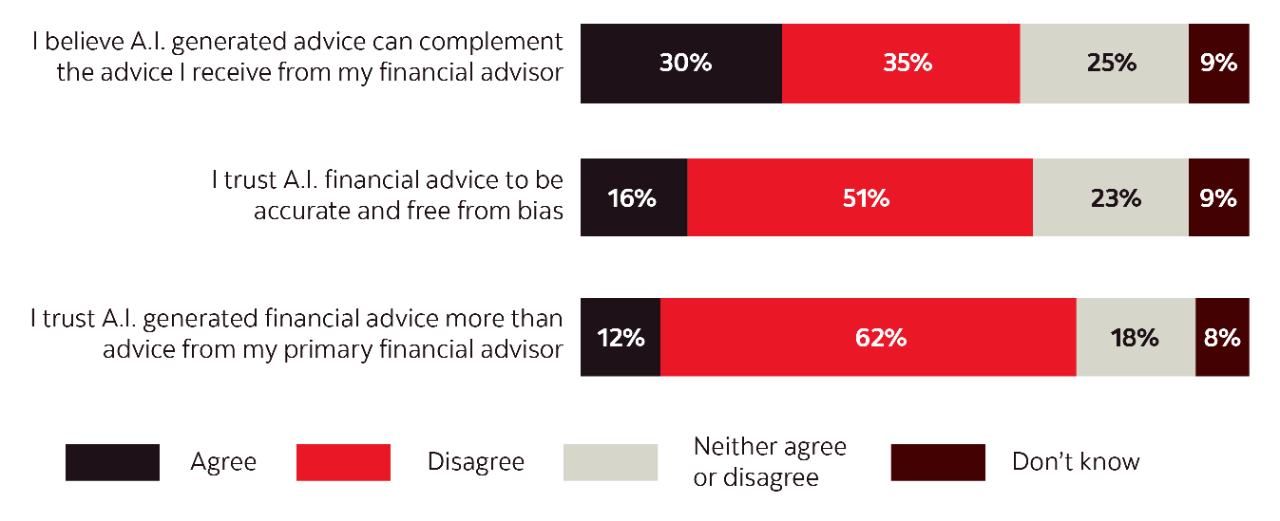

Figure 6: Investors remain wary of A.I. generated financial advice

A.I. can assist, but shouldn’t replace personalized guidance. A.I. and social media can be practical tools for learning about finances and investments, but accuracy is inconsistent and they lack the personal context needed to create nuanced investment or financial plans or make high-stakes decisions. For important financial decisions, the most useful role for A.I.-powered advice is as support, not substitution, for an experienced, human professional.

Having a financial plan and an advisor helps strengthen confidence

Our research has shown that, year after year, investors feel more optimistic about reaching their goals when they work with an advisor and have a financial plan in place. These investors express more confidence in their portfolios and their ability to fund their retirement.

Even in years of record market performance, as seen in 2025, our survey shows how economic uncertainties can weaken investor confidence as people are forced to reevaluate financial priorities. An advisor can help you avoid emotional decision-making in challenging times, to adjust and rebalance plans as needed — and look for opportunities — without losing sight of the end goal.

To learn more reach out to your advisor.